Trust and Safety Services

Trust and Safety

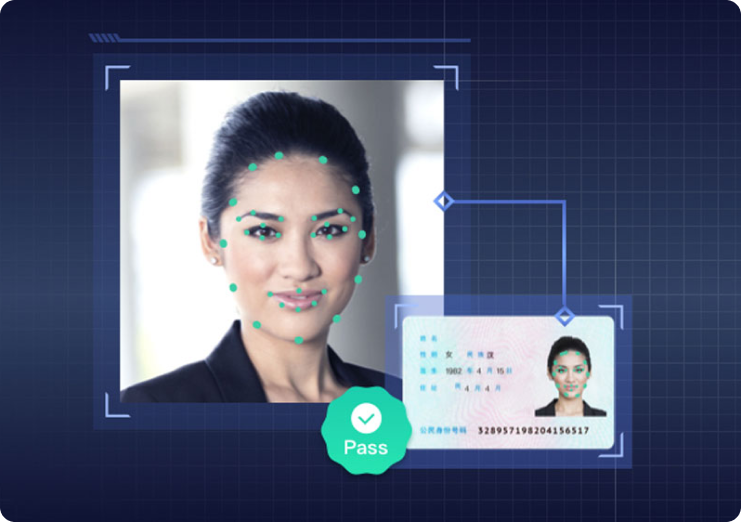

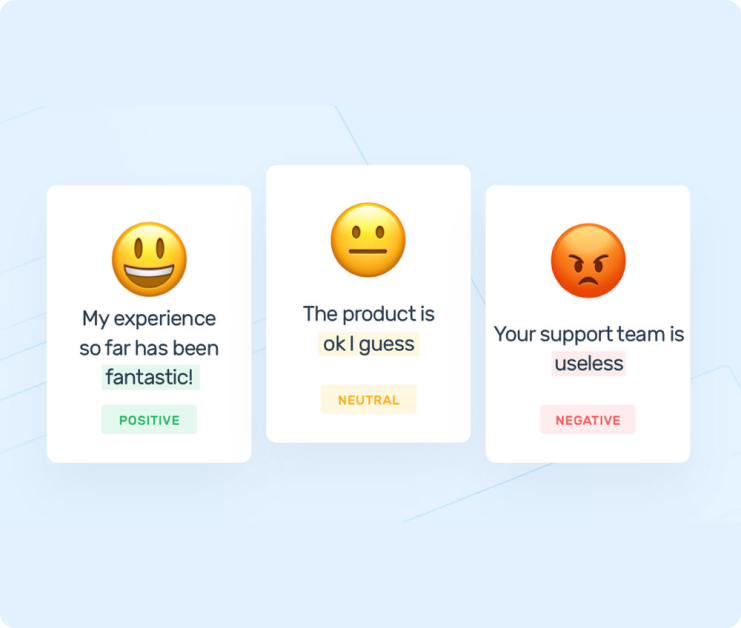

At NextWealth, we provide end-to-end Trust & Safety solutions that go beyond content moderation to ensure KYC compliance, identity verification, community guidelines enforcement, and regulatory risk management. Our Human-in-the-Loop (HITL) approach, combined with advanced AI, enables accurate identity verification to prevent fraud while ensuring seamless onboarding. We help businesses enforce community standards, tackling misinformation, hate speech, and harmful content to maintain safe digital spaces. Our expertise in risk assessment and compliance ensures platforms adhere to evolving regulations, reducing liability and enhancing user trust. By integrating proactive moderation, fraud prevention, and regulatory alignment, NextWealth empowers organizations to build safer, more reliable digital ecosystems while maintaining compliance with global standards.

Our areas of expertise

Why choose NextWealth as your

annotation partner

Dedicated Expertise

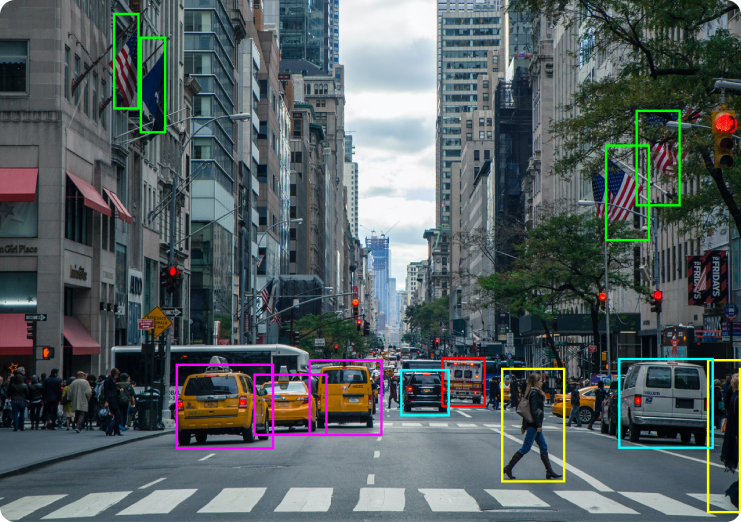

We specialize in providing scalable annotation services across domains like autonomous vehicles, healthcare, and retail. Our team’s experience in Trust and Safety Services strengthens AI applications by ensuring data is accurately labeled for safer deployments.

Client-Focused Delivery

Our collaborative approach ensures the solutions we deliver are customized to meet the specific needs of your project. This includes tailoring digital safety solutions that align with your platform’s unique requirements.

Efficiency with Accuracy

Our HITL methodology guarantees results that exceed 98% in Precision and Recall benchmarks.

Scalable and Cost-Effective

From POCs to production-level deployments, our robust infrastructure and expert teams deliver results efficiently and economically. This scalability is critical for trust and safety programs that must grow with your user base.

Successful client stories and case studies

Deep dive into our journey of partnering with the global business giants.

Real-time Digital Identity Verification

for a US based identity verification company

1 min read

Learn More

Why partner with us

Our services are tailored to elevate the efficiency of your AI/ML processes

Managed Services l Captive Services l Staffing Services

Skilled

Employees

Data

Transactions

Live Projects

Fortune 500

Clients

NPS Score

Testified and trusted by

the best in the world of business

I am really happy at all the great things we have been able to achieve in the past 1 year. The relationship now has a solid foundation, and I am sure NextWealth will continue to be a formidable partner going ahead, bringing a delightful experience for our customers.

NextWealth has been an invaluable partner to us, significantly accelerating our growth by handling critical data operations and providing strategic insights.

NextWealth’s hard work and dedication are truly making a difference, streamlining our processes significantly. We really appreciate it!

My experience with NextWealth has been wonderful. The diligent team consistently delivers on time with a focus on quality. Their innovation-driven mindset fosters a win-win situation for both teams.

I am happy with the improvement in the performance. I have seen positive improvement, and we have a long way to go.

NextWealth’s in-depth analysis helped us pinpoint exactly what needs to be done to address the issues.

With excellence in Quality, Cost, and TAT—key pillars of any operation—NextWealth sets a benchmark for operational efficiency and beyond.

We have experienced significant growth—a success we could not have achieved without the expert support, hard work, and commitment of NextWealth.

Explore Resources

Know how we are accelerating business growth by enabling effectiveness in AI/ML

How Video Annotation Transforms Surveillance into Situational Awareness for Real-Time AI

1 min read

Reducing Computer Vision Errors with Precision: The Role of Polygon Annotation

1 min read

FAQs

Lorem ipsum dolor sit amet consectetur. Nunc pretium et magna leo pellentesque duis.

Lorem ipsum dolor sit amet consectetur. Netus nullam non consequat sit aliquet ullamcorper cursus. Diam egestas eu malesuada imperdiet urna felis morbi dis aliquam. Pharetra amet libero nisi risus arcu blandit a morbi morbi. Lacus nec in venenatis risus. Quam amet faucibus scelerisque eleifend. Pellentesque ornare ultrices aliquet enim urna. Mi consectetur ut maecenas nunc luctus egestas feugiat.

Pellentesque felis tempor volutpat leo luctus egestas ornare. Vulputate bibendum dui vulputate non massa. Quis enim neque arcu eu ac risus est sed.

Lorem ipsum dolor sit amet consectetur. Lacus.

Lorem ipsum dolor sit amet consectetur. Netus nullam non consequat sit aliquet ullamcorper cursus. Diam egestas eu malesuada imperdiet urna felis morbi dis aliquam. Pharetra amet libero nisi risus arcu blandit a morbi morbi. Lacus nec in venenatis risus. Quam amet faucibus scelerisque eleifend. Pellentesque ornare ultrices aliquet enim urna. Mi consectetur ut maecenas nunc luctus egestas feugiat.

Pellentesque felis tempor volutpat leo luctus egestas ornare. Vulputate bibendum dui vulputate non massa. Quis enim neque arcu eu ac risus est sed.

Lorem ipsum dolor sit amet consectetur. Sem purus eget pretium at amet ultrices tempor. Lectus viverra lacinia tristique est id varius est. Risus in duis a congue odio.

Lorem ipsum dolor sit amet consectetur. Netus nullam non consequat sit aliquet ullamcorper cursus. Diam egestas eu malesuada imperdiet urna felis morbi dis aliquam. Pharetra amet libero nisi risus arcu blandit a morbi morbi. Lacus nec in venenatis risus. Quam amet faucibus scelerisque eleifend. Pellentesque ornare ultrices aliquet enim urna. Mi consectetur ut maecenas nunc luctus egestas feugiat.

Pellentesque felis tempor volutpat leo luctus egestas ornare. Vulputate bibendum dui vulputate non massa. Quis enim neque arcu eu ac risus est sed.

Lorem ipsum dolor sit amet consectetur. Neque lorem et enim tempus. Vitae.

Lorem ipsum dolor sit amet consectetur. Netus nullam non consequat sit aliquet ullamcorper cursus. Diam egestas eu malesuada imperdiet urna felis morbi dis aliquam. Pharetra amet libero nisi risus arcu blandit a morbi morbi. Lacus nec in venenatis risus. Quam amet faucibus scelerisque eleifend. Pellentesque ornare ultrices aliquet enim urna. Mi consectetur ut maecenas nunc luctus egestas feugiat.

Pellentesque felis tempor volutpat leo luctus egestas ornare. Vulputate bibendum dui vulputate non massa. Quis enim neque arcu eu ac risus est sed.